Higher inflation, ongoing labor challenges, and a slowly improving supply chain will shape construction for the next two years

By / Jessica Kirby

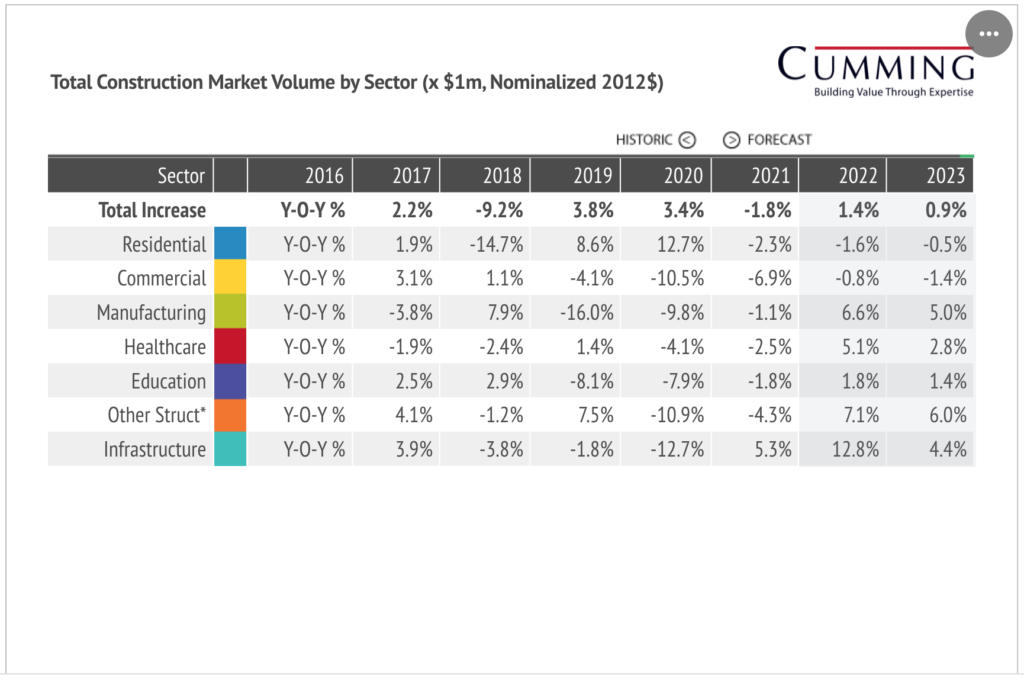

The forecast for 2022 is positive in the Greater Seattle construction market. Experts predict 6% growth for 2022, a rate that will see steady increased and an eventual return to near-normal levels. Beyond that, the industry may experience a slight contraction, mostly because of residential and pre-pandemic projects wrapping up. It is important to note, however, that residential construction accounts for more than half the volume of construction in the market, which means large, multi-trade contractors may not feel fluctuations as deeply as those focused primarily on residential and service contracts.

Growth hasn’t been entirely even, either. Seattle’s Eastside has seen several new projects, while downtown has cooled a bit and now has a surplus of office space. Tech firms like Meta and Amazon drive demand for office space and housing, but with work-from-home and hybrid work arrangements in place, this demand remains in precarious balance.

Even with the slight dip expected for 2023, the Seattle market continues to hold important opportunities as the city is expected to invest heavily in sustainable and green initiatives. Seattle set a carbon neutral goal back in 2010 to divest from fossil fuels by 2030 and become completely carbon neutral by 2050—and these deadlines are fast-approaching. Implementation and forward-looking plans for a greener city are top of mind. Public transportation investments (to reduce commute-related pollution and traffic) include trams, light-rail, and mixed-use developments. New powerplants to address dependence on fossil fuels, and greener buildings (like Climate Pledge Arena, which recycles rain water into ice for the Seattle Kraken to play on) are on the horizon.

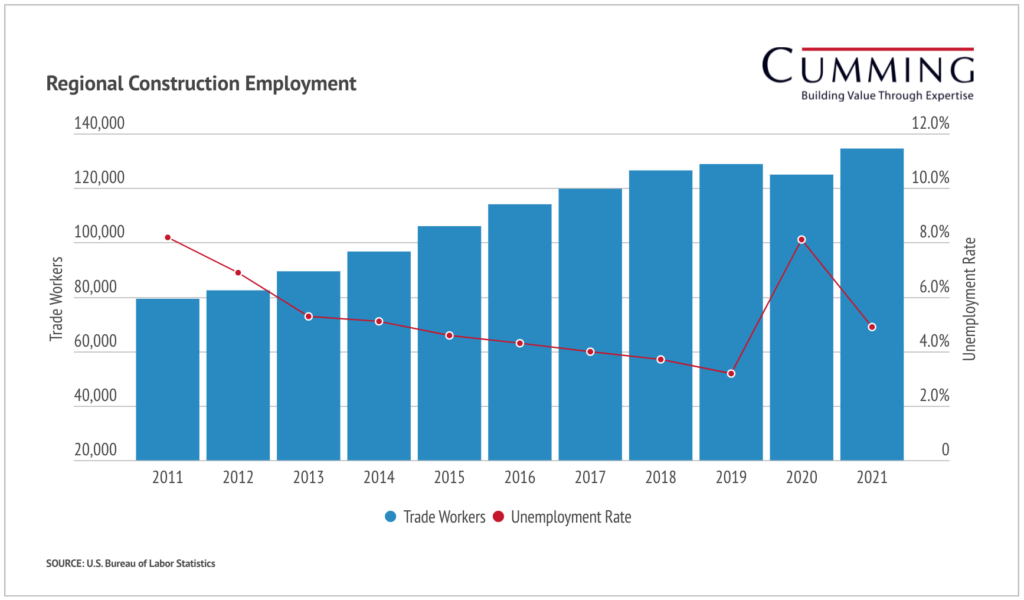

Labor is always a focus for the entire constriction industry, and although shortages still exist, the labor market is showing improvement, thanks to involved and collaborative recruitment strategies. There were labor gains in 2021, but demand has outpaced volume, so further recruitment and retention action is needed.

Associated General Contractors of America (AGCA) published a study at the beginning of the year, which reported that most metropolitan areas have not seen the labor success the Seattle market has experienced over the past two years. While less than a third of the 358 urban areas in the study saw construction job growth since the onset of the pandemic, Washington saw construction employment rise 2%, adding 222,000 jobs to the state economy. Seattle, Bellevue, and Everett combined for a 5% growth in construction jobs, and Seattle alone added 5,300 new construction jobs. The Tacoma-Lakewood area came in a close second with a 4% increase.

This follows a significant national drop between March 2020 and March 2021, which indicated a 57% decrease in work in construction because of supply chain disruption, canned projects, and the soaring cost of building materials.

And this is, of course, the issue on everyone’s minds: supply and materials. The cost of construction materials rose during the fourth quarter of 2021 at a national average of 1.5%, according to a new report. Seattle led the survey with a 5% quarterly increase. Last month, a report from the National Association of Home Builders (NAHB) blamed rising costs for building materials like lumber adding $24,000 to the average new home price.

An article in ACHRNews says large HVAC manufacturers have seen increases in annual sales over the past two years, thanks to continued consumer spending and increased interest in IAQ, but supply chain issues continue to pressure timelines. Robert Dietz, NAHB’s chief economist, says policy makers will play a key role in creating a solution, although inflation will be a top economic challenge for 2022 and 2023. Any help policy makers can offer by improving supply chains will help fight inflationary pressures, he says.

Anirban Basu, economist with the Sage Policy Group, spoke at the 2022 Partners in Progress Conference about inflation, the US economy, and what to look out for moving forward.

“The economy is an egg and we broke it,” Basu said. “It has been difficult to reconstitute due to several important market issues.”

He discussed key trends affecting spending, labor, and ongoing pressures and opportunities. For example, 68% of Americans want to work remotely, which both changes current and future demand for office space and drives growth in the modernization of existing office space. Malls are seeing less foot traffic because of online shopping, but these spaces may be retrofitted for other uses, including fulfillment facilities or even multi-residential housing.

Overall, Basu said, American and Canadian commercial construction investment is not going to be strong going forward, and elevated supply costs are going to delay growth in this sector as developers wait to proceed until costs decrease.

He forecasts that consumer misery resulting from inflationary pressure is driving increased shopping dollars, which means general consumer spending is up. While the supply chain still suffers, it is improving with more noticeable changes coming this fall. Supply issues will continue into 2024, however, partly because of on-going labor force shortages. Young people are more concerned about work life balance, so this can’t be solved by money.

In 2022, school construction is expected to rise, inflation will continue to grow, but supply and services will keep up with demand. That means higher than average economy-wide inflation, increased interest rates, and rapid declines in commodity prices are all on the books for this year.

There is an enormous appetite for manufacturing coming home to the United States, as this would better protect intellectual properties and minimize shipping costs, but labor continues to be a problem that may delay progress in this area. He says that because America’s population is growing very slowly, improvements in the labor supply will rely on changes to legal immigration policies and the introduction of productivity-focused technology.

As far as environmental mandates and their effects on construction, oil production is down and the discussion is about net zero goals. The change to renewable means oil companies are trying to get ahead of the curve, and oil prices will continue to grow until the electric car industry takes hold.▪